Recently, with the emergence of cryptocurrencies, the global financial landscape has changed a lot. Decentralized and often operating on blockchain technology, these digital assets have not only grabbed the public’s attention, but they’re also becoming a subject of geopolitical intrigue. Cryptocurrencies could be used to navigate the complex web of international sanctions by the Russian elite, which is pretty cool. We’re going to dig into the intricacies of this topic, whether Russia’s elite employ digital assets as a strategy.

Understanding Cryptocurrency in the Global Context

Bitcoin is the most famous cryptocurrency, but cryptocurrencies have grown beyond niche interest to become major players in the finance world. People and companies want to bypass traditional financial systems and regulations because of their decentralized nature, which offers anonymity and autonomy. The role of cryptocurrencies in international relations has come under scrutiny, especially as nations facing sanctions grapple with them.

The Sanctions Landscape

We need to understand the sanctions landscape Russia’s been navigating before we can talk about how it might use cryptocurrencies. Western nations have imposed economic sanctions on Russia due to geopolitical events and allegations of violations of international norms. In addition to asset freezes, trade restrictions have put pressure on Russia’s economy.

Cryptocurrency as a Potential Escape Route

A question arises: Are Russian elites using cryptocurrencies to circumvent sanctions in this tough economic climate? Traditional banks and governments can’t track and control crypto transactions because they’re decentralized. As a result of this characteristic, the Russian elite have been speculating about using digital assets to move and protect money.

The Case for Cryptocurrency Adoption

A lot of people think the Russian elite should adopt cryptocurrencies to diversify assets and protect themselves from sanctions. It’s easy to hide money and get secure with cryptocurrencies, so they’re a good option for people facing scrutiny and restrictions. Aside from that, cryptocurrencies allow cross-border transactions, so you can move your money around no matter what sanctions you’re subject to.

Challenges and Risks

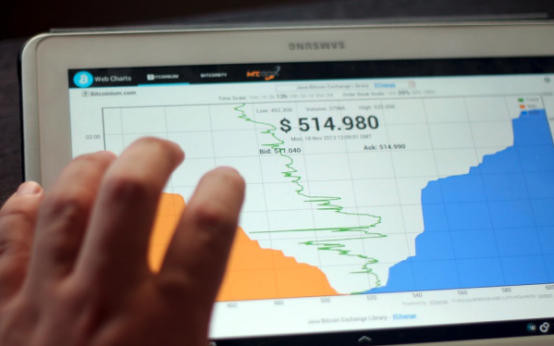

While the potential use of cryptocurrencies by Russia’s elite may seem plausible, it is essential to acknowledge the challenges and risks associated with such endeavors. The volatility of cryptocurrency markets poses a significant risk to those seeking to preserve wealth, as the value of digital assets can experience rapid and unpredictable fluctuations. Moreover, the Regulatory Safeguards in Stablecoins Market and environment surrounding cryptocurrencies is evolving, and governments are increasingly taking steps to address potential illicit activities related to digital assets.

International Response and Cooperation

As the use of cryptocurrencies in response to sanctions gains attention, there is a growing need for international collaboration to regulate and monitor digital asset transactions. The Financial Action Task Force (FATF) and other regulatory bodies are actively working to establish guidelines and frameworks to address the potential misuse of cryptocurrencies for illicit purposes. Cooperation among nations is crucial to ensure the effectiveness of these efforts and to maintain the integrity of the global financial system.

Conclusion

The role of cryptocurrencies in the context of Russia’s elite navigating sanctions is a multifaceted and evolving issue. The decentralized and relatively anonymous nature of digital assets presents both opportunities and challenges for those seeking to employ them as a strategic tool. While the potential benefits of using cryptocurrencies to circumvent sanctions exist, the risks and uncertainties associated with this approach cannot be ignored.

In decrypting the role of cryptocurrency, it is essential to recognize the complex interplay between technology, geopolitics, and financial systems. The global community must remain vigilant in monitoring and responding to the use of cryptocurrencies in ways that may undermine the efficacy of sanctions. As the world continues to grapple with the evolving landscape of digital assets, understanding and addressing the role of cryptocurrencies in navigating sanctions will be crucial for shaping the future of international relations.

A Beginner’s Guide to Blockchain Technology

A Beginner’s Guide to Blockchain Technology  Cryptocurrencies Uncovered in Cybercrime

Cryptocurrencies Uncovered in Cybercrime  Bitcoin Futures and Cryptocurrency Market Dynamics

Bitcoin Futures and Cryptocurrency Market Dynamics  Cryptocurrency: Digital Currency in Marshall Islands

Cryptocurrency: Digital Currency in Marshall Islands  Bitcoin’s Evolution: Five Investor Demographics

Bitcoin’s Evolution: Five Investor Demographics  Facebook: Cryptocurrency for a Digital Nation

Facebook: Cryptocurrency for a Digital Nation