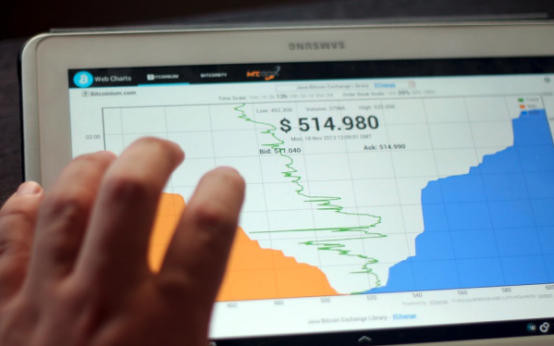

The digital monetary revolution that cryptocurrency has sparked has been undeniable, with Bitcoin being the poster child. There’s a continuous quest to understand and predict what’s affecting the cryptocurrency market, thanks to its notorious volatility. Recent attention has focused on how Bitcoin futures trading impacts the crypto market in general, particularly in light of the perceived bubble. We’re going to dive into the intricacies of Bitcoin futures trading, and how they play a role in the ever-evolving cryptocurrency industry.

Understanding Bitcoin Futures Trading

Before delving into the potential impact, it’s crucial to grasp the basics of Bitcoin futures trading. Futures contracts are financial derivatives that allow traders to speculate on the future price movements of an asset, in this case, Bitcoin. Unlike spot trading, where assets are bought or sold for immediate delivery, futures contracts set a predetermined price for the future exchange of Bitcoin. This introduces an element of risk and reward, amplifying the market dynamics and potentially influencing overall market sentiment.

The Evolution of Cryptocurrency Markets

Over the years, cryptocurrency markets have matured, attracting institutional investors and traditional financial institutions. The introduction of Bitcoin futures on major exchanges has been a pivotal development in this evolution. The involvement of institutional players brings a level of sophistication and liquidity to the market, but it also introduces complexities and potential risks that differ from the dynamics observed in the early days of Bitcoin.

The Debate Surrounding Market Bubbles

The term “bubble” has been associated with the cryptocurrency market due to its history of rapid price surges followed by sharp corrections. Some argue that these fluctuations are inherent to an emerging market, while others express concerns about the creation and bursting of speculative bubbles. The introduction of Bitcoin futures trading has added a layer of complexity to this debate, with proponents and sceptics offering contrasting views on its role in market dynamics.

Potential Impact of Bitcoin Futures Trading on Market Dynamics

Analysing the potential impact of Bitcoin futures trading involves considering multiple factors. One key aspect is the influence of institutional money. The entry of institutional investors into the cryptocurrency space through futures trading can bring stability and legitimacy. However, it also introduces the potential for market manipulation and coordinated efforts that could amplify price swings.

Moreover, the nature of futures contracts introduces a time element to trading decisions. Traders must not only predict the direction of price movements but also accurately forecast the timing. This time sensitivity can lead to increased volatility as traders adjust their positions based on short-term market trends, potentially contributing to rapid price fluctuations.

Risk Management and Market Sentiment

Bitcoin futures trading also plays a role in shaping market sentiment. Traders and investors closely monitor futures markets for signals and indications of future price movements. The impact of large trades, market sentiment indicators, and open interest on futures contracts can significantly influence the broader market, potentially exacerbating bullish or bearish trends.

Additionally, the availability of futures contracts allows for sophisticated risk management strategies. Institutional players can use futures to hedge against price volatility, providing a tool for managing risk in a market known for its price unpredictability. However, these risk management practices also have the potential to create feedback loops, where market reactions to perceived risks contribute to increased volatility.

Regulatory Considerations and Market Integrity

As the cryptocurrency market continues to evolve, regulatory oversight becomes a critical factor. The potential impact of Bitcoin futures trading on the market bubble is closely tied to regulatory developments. A lack of clear regulations or sudden regulatory changes can introduce uncertainty and volatility, impacting market participants and potentially leading to sharp market corrections.

Market integrity is a paramount concern, with regulators aiming to prevent market manipulation, fraud, and other illicit activities. The transparent and regulated operation of Bitcoin futures markets is essential for fostering confidence among investors and ensuring the stability of the broader cryptocurrency market.

Conclusion

Analysing the potential impact of Bitcoin futures trading on the cryptocurrency market bubble reveals a complex interplay of factors. The evolution of crypto digital currency markets, the entry of institutional players, risk management strategies, and regulatory considerations all contribute to the dynamics of this rapidly changing landscape. While Bitcoin futures trading has the potential to bring stability and sophistication to the market, it also introduces new challenges and risks.

As the cryptocurrency market continues to mature, understanding and mitigating these risks will be crucial for ensuring the long-term sustainability and success of digital assets. The ongoing debate surrounding market bubbles and the role of Bitcoin futures trading underscores the need for thoughtful analysis and regulatory frameworks that strike a balance between innovation and investor protection.

In this ever-evolving landscape, staying informed and adapting to changes will be key for market participants. The potential impact of Bitcoin futures trading on the cryptocurrency market bubble remains a topic of ongoing research and discussion, highlighting the importance of continuous monitoring and analysis as the cryptocurrency journey unfolds.

A Beginner’s Guide to Blockchain Technology

A Beginner’s Guide to Blockchain Technology  Cryptocurrencies Uncovered in Cybercrime

Cryptocurrencies Uncovered in Cybercrime  Cryptocurrency: Digital Currency in Marshall Islands

Cryptocurrency: Digital Currency in Marshall Islands  Bitcoin’s Evolution: Five Investor Demographics

Bitcoin’s Evolution: Five Investor Demographics  Facebook: Cryptocurrency for a Digital Nation

Facebook: Cryptocurrency for a Digital Nation  Privacy Concerns: National Digital Currencies

Privacy Concerns: National Digital Currencies