There has been both excitement and apprehension around the world financial landscape since national digital currencies came into existence. Considering the impact on user privacy is a critical aspect of implementing digital currencies as governments around the world contemplate them. Our article focuses on the privacy concerns surrounding national digital currencies, examining how technology and financial surveillance fit together.

Understanding National Digital Currencies

We need to understand national digital currencies first before we can get into privacy concerns. Central Bank Digital Currencies (CBDCs) are digital currencies issued and regulated by their central banks. CBDCs aren’t decentralized cryptocurrencies as Stocks and Crypto like Bitcoin, which work on a peer-to-peer network. They’re centralized and usually run on distributed ledgers.

The Promise of Efficiency

The government touts national digital currencies’ efficiency, affordability, and financial inclusion. Transactions can happen seamlessly, cutting down on processing times and reducing the reliance on physical currency. We’re moving towards a cashless society, though, so convenience vs. privacy becomes more important.

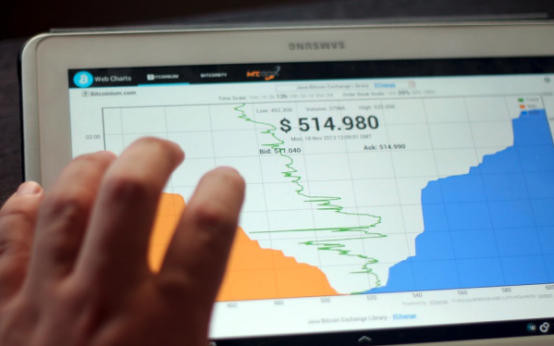

The Double-Edged Sword of Transparency

CBDCs are cited for their transparency. Every transaction is recorded on the distributed ledger, so it’s an immutable record. Transparency helps prevent fraud and ensure accountability; it raises red flags about privacy. Every financial move becomes traceable, which challenges traditional notions of financial privacy.

Privacy Concerns Surrounding CBDCs

Surveillance and Control

Governments could spy on you more with national digital currencies, one of the major concerns. Authorities could get unprecedented insight into individuals’ financial activities if every transaction was recorded on a centralized ledger. It’s hard to balance national security with financial privacy when you do that kind of surveillance.

Data Security and Cyber Threats

As digital currencies take over, data security concerns are on the rise. A successful hack can expose sensitive financial information, putting individuals at risk of identity theft, fraud, and other bad stuff. Public trust depends on safeguarding these digital systems.

Social Credit Systems and Discrimination

Social credit systems are being integrated by some governments, where citizens get scores based on their behavior’s, finances, and social interactions. CBDCs could let governments enforce and manipulate these systems, causing people to be discriminated against based on their financial history. I don’t like the idea of financial data being misused as a control tool.

Striking a Balance

Although privacy concerns are valid, it’s important to acknowledge that governments are doing some work on them. The successful implementation of national digital currencies depends on striking a balance between CBDCs’ advantages and individual privacy.

Enhanced Privacy Features

CBDCs are getting enhanced privacy features from governments and central banks. We’re thinking about using zero-knowledge proofs and privacy coins to make it easy for users to transact anonymously while still following regulations.

Educating the Public

The key to addressing privacy concerns is transparency and education. It’s important for governments to talk to the public about how they protect individual privacy, what surveillance can’t do, and how to balance security and freedom.

Conclusion

We can’t ignore the privacy issues surrounding national digital currencies as nations explore the implementation of these innovations. It’s crucial for CBDCs to be integrated into the financial landscape successfully that they strike the right balance between efficiency and privacy. With technology evolving, governments need to adapt policies and incorporate privacy-centric features to keep the financial future both innovative and safe.

A Beginner’s Guide to Blockchain Technology

A Beginner’s Guide to Blockchain Technology  Cryptocurrencies Uncovered in Cybercrime

Cryptocurrencies Uncovered in Cybercrime  Bitcoin Futures and Cryptocurrency Market Dynamics

Bitcoin Futures and Cryptocurrency Market Dynamics  Cryptocurrency: Digital Currency in Marshall Islands

Cryptocurrency: Digital Currency in Marshall Islands  Bitcoin’s Evolution: Five Investor Demographics

Bitcoin’s Evolution: Five Investor Demographics  Facebook: Cryptocurrency for a Digital Nation

Facebook: Cryptocurrency for a Digital Nation