The financial markets are changing, so a new player has emerged, and they don’t wear suits and ties. The influence of memes on financial markets has grown from GameStop’s meteoric rise to Dogecoin’s seemingly unstoppable rise. Taking Centre stage in shaping market trends is memes, and this article examines how internet culture, social media, and traditional finance interact.

The GameStop Saga

As a group of retail investors from Reddit’s WallStreetBets took on hedge funds in a David-and-Goliath battle in early 2021, GameStop caught the world’s attention. I think this financial wildfire started with a meme – a funny image that stood up to Wall Street giants. In the beginning of the 1970s, “stonks” became synonymous with a grassroots movement that challenged conventional wisdom.

Memes as Market Catalysts

GameStop showed how memes can make you feel strong. Memes rally individual investors who find strength in numbers. It turned out that social media platforms, especially Reddit and Twitter, were breeding grounds for financial memes that transcended the virtual world and affected real-life decisions. There was a paradigm shift here, as traditional finance institutions felt the pressure of democratizing market power.

Dogecoin

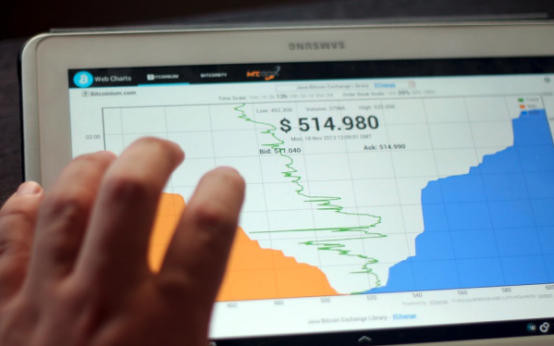

GameStop opened the show, but Dogecoin took over. Originally created as a joke cryptocurrency that Tesla’s Climate Caution: Crypto’s Wake-Up Call based on the popular Shiba Inu meme, Dogecoin became a serious contender in the crypto space. Its value skyrocketed as online communities rallied behind it, fueled by memes and celebrity endorsements. Meme-driven financial movements are unpredictable and transformative, just like Dogecoin’s journey from internet joke to market force.

The Role of Social Media in Meme Finance

Social media platforms have become the epicenter of meme finance, providing a stage for retail investors to share ideas, memes, and market analyses. The speed at which information travels on these platforms amplifies the impact of memes, turning them into catalysts for rapid market movements. This interconnectedness between online communities and financial markets challenges the traditional top-down flow of information, democratizing financial discussions and decision-making processes.

The Dark Side

While memes have injected an element of excitement and unpredictability into financial markets, they also pose risks. The speculative nature of meme-driven investments can lead to market volatility and inflated asset prices, creating a breeding ground for bubbles that can burst unexpectedly. Regulators and traditional financial institutions are grappling with the challenge of balancing market innovation and investor protection in this brave new world of meme finance.

Lessons Learned

As the phenomenon of memes shaping financial markets continues to evolve, there are valuable lessons to be learned. Traditional finance must adapt to the changing landscape, recognizing the influence of online communities and the democratization of information. Establishing a balance between innovation and regulation will be crucial to navigating the meme economy responsibly, ensuring that market integrity is upheld while allowing for the organic growth of new and unconventional investment trends.

Conclusion

From GameStop to Dogecoin, the phenomenon of memes shaping financial markets has ushered in a new era of unpredictability and excitement. The internet-driven democratization of financial influence has challenged established norms and created a more inclusive space for individual investors. As we navigate this evolving landscape, it’s clear that the power of memes in finance is not a fleeting trend but a force to be reckoned with. The journey “From GameStop to Dogecoin: The Phenomenon of Memes Shaping Financial Markets” is a testament to the resilience and adaptability of financial markets in the face of unconventional influencers. As we move forward, it is crucial to embrace this unpredictable future, learning from the lessons of the past while remaining open to the transformative power of memes in shaping the financial world.

A Beginner’s Guide to Blockchain Technology

A Beginner’s Guide to Blockchain Technology  Cryptocurrencies Uncovered in Cybercrime

Cryptocurrencies Uncovered in Cybercrime  Bitcoin Futures and Cryptocurrency Market Dynamics

Bitcoin Futures and Cryptocurrency Market Dynamics  Cryptocurrency: Digital Currency in Marshall Islands

Cryptocurrency: Digital Currency in Marshall Islands  Bitcoin’s Evolution: Five Investor Demographics

Bitcoin’s Evolution: Five Investor Demographics  Facebook: Cryptocurrency for a Digital Nation

Facebook: Cryptocurrency for a Digital Nation