In the ever-evolving landscape of digital currencies, Bitcoin stands as a pioneering force that has captured the imagination of investors worldwide. Its journey from obscurity to mainstream acceptance has been nothing short of remarkable. In this article, we delve into the multifaceted evolution of Bitcoin, examining the crucial role played by five distinct investor groups in shaping its trajectory.

The Early Adopters

Early adopters of Bitcoin recognized its potential and opened a new era in finance in 2009. These visionaries saw Bitcoin not just as a digital currency, but also as a revolutionary concept challenging traditional financial systems. Cryptography enthusiasts, libertarians, and techie people were the nucleus of this group.

A community-driven movement would later attract a broader audience because of the early adopters’ belief in Bitcoin’s decentralized ethos.

Speculators and Traders

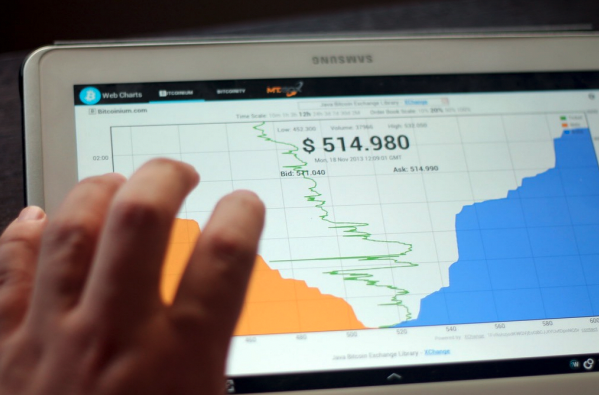

Second wave of investors emerged as Bitcoin gained traction – speculators and traders. They bought and sold cryptocurrencies with the intent of making short-term gains because the cryptocurrency’s price fluctuate a lot. There were wild price fluctuations on the market, and exchanges flourished.

Speculators and traders introduced liquidity to the Bitcoin market, but their activities also brought increased scrutiny and regulatory attention. The interplay between this group and regulatory bodies marked a critical juncture in Bitcoin’s journey, shaping its image and paving the way for a more mature market.

Institutional Investors

Institutional investors have entered the Bitcoin space recently, bringing legitimacy and stability you didn’t see before. A lot of hedge funds, family offices, and even public companies are putting money into Bitcoin, because they see it as a store of value and a hedge against inflation.

In addition to increasing Bitcoin’s market cap, institutional investors have changed perceptions in traditional financial circles, making it more acceptable. Bitcoin is getting closer to mainstream adoption and integration into conventional investments during this phase.

Retail Investors

Simultaneously, the rise of user-friendly platforms and the ease of access to Bitcoin have democratized finance, allowing retail investors to participate actively. The surge in interest from individual investors, often referred to as the “retail boom,” has been a driving force behind Bitcoin’s continued ascent. Apps, payment processors, and investment platforms like Facebook: Cryptocurrency for a Digital Nation have made it simpler for everyday people to buy, hold, and transact in Bitcoin.

The involvement of retail investors has added a layer of decentralization, aligning with the original vision of a peer-to-peer digital currency. This diverse participation fosters a resilient and inclusive ecosystem, strengthening Bitcoin’s position as a financial asset accessible to all.

Technological Innovators

In addition to Bitcoin’s journey, technology innovators are pushing the boundaries of blockchain technology constantly. In addition to Bitcoin, these innovators look at how the underlying technology can be used for smart contracts, decentralized finance (DeFi), and non-fungible tokens (NFTs).

Their experiments and advancements contribute to the overall development of the blockchain ecosystem, reinforcing Bitcoin’s status as a foundational element. As the technology evolves, it opens new avenues for applications, further expanding the relevance and utility of Bitcoin.

Conclusion

Decoding Bitcoin’s journey unveils a narrative shaped by the dynamic interplay of five diverse investor groups. From the pioneers who recognized its disruptive potential to the institutional investors bringing legitimacy, each phase has left an indelible mark on Bitcoin’s evolution. The journey also reflects the decentralized ethos at the core of Bitcoin, with retail investors and technological innovators contributing to its resilience and adaptability.

As Bitcoin continues to evolve, the collective impact of these investor groups highlights its growing significance in the broader financial landscape. The story of Bitcoin is far from static; instead, it is a testament to the adaptability and transformative power of decentralized digital currencies. In decoding Bitcoin’s journey, we witness not just a financial revolution but a paradigm shift that challenges traditional notions of value and ownership

A Beginner’s Guide to Blockchain Technology

A Beginner’s Guide to Blockchain Technology  Cryptocurrencies Uncovered in Cybercrime

Cryptocurrencies Uncovered in Cybercrime  Bitcoin Futures and Cryptocurrency Market Dynamics

Bitcoin Futures and Cryptocurrency Market Dynamics  Cryptocurrency: Digital Currency in Marshall Islands

Cryptocurrency: Digital Currency in Marshall Islands  Facebook: Cryptocurrency for a Digital Nation

Facebook: Cryptocurrency for a Digital Nation  Privacy Concerns: National Digital Currencies

Privacy Concerns: National Digital Currencies