In the ever-evolving landscape of cryptocurrencies, one aspect that needs immediate attention is the volatility associated with stablecoins. Digital assets like these, designed to keep their value stable by pegged to reserve assets, have a lot of uses in finance. Their price fluctuations pose a big risk to consumers and the financial system overall. Regulatory safeguards are needed to ensure consumer protection and navigate stablecoins volatility.

Understanding Stablecoins

Bitcoin and Ethereum’s Sustainable Cryptocurrency are notoriously volatile, so stablecoins are supposed to keep them out of it. By pegging their value to a reserve asset, usually a fiat currency like the US Dollar or a commodity like gold, they get this stability. By pegging digital currencies, users get the benefits without worrying about price fluctuations.

The Volatility Challenge

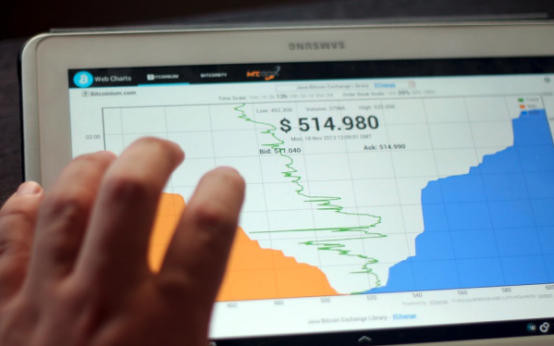

Market fluctuations aren’t immune to stablecoins, despite their intended stability. Recent incidents have shown stablecoins deviated from their pegged price, causing concern for users and regulators alike. Insufficient collateralization, liquidity issues, and market dynamics are causing volatility. These factors make it urgent to take action.

Consumer Protection

Stablecoins are now integrated into a bunch of financial services, from decentralized finance platforms to cross-border payments, so consumers need tougher consumer protection. Stablecoins expose consumers to unforeseen risks in times of volatility because they’re often unaware of their underlying mechanisms. To keep users safe and informed, regulations are crucial.

The Role of Regulators

Stablecoins need a secure and stable environment. You can boost the credibility of stablecoin issuers by establishing clear guidelines about reserve requirements, regular audits, and transparent reporting. To address the cross-border issues with stablecoins and create uniform guidelines, international regulatory organizations need to work together. This cooperation is essential to developing a stablecoin environment that keeps users safe and consistent across the globe.

Together, the regulatory bodies can tackle such threats and establish a strong structure that encourages stability and trust in stablecoin usage globally. Protecting consumer interests and preserving the integrity of the global financial system depend on this concerted effort.

The Urgent Imperative for Regulatory Safeguards

Addressing Systemic Risks

Almost everyone is concerned about stablecoins; their widespread adoption poses a systemic risk to the economy as a whole. Stablecoins could lose their confidence suddenly and widely, impacting other financial instruments and institutions. There’s a need for regulatory safeguards to stop these systemic risks and make the whole thing stable.

Ensuring Transparency and Accountability

Regulatory frameworks should require stablecoin issuers to provide real-time data about their reserves so we can keep the pegged value. Transparency turns out to be the key to building confidence in the stablecoin space. An essential accountability mechanism is imposed by requiring independent third parties to undertake frequent audits of stablecoin issuers.

This procedure guarantees that stablecoin issuers’ financial operations are transparent to the public, which instills trust in both users and stakeholders. In the end, transparency serves as the cornerstone around which a stablecoin ecosystem reliable and strong can be constructed.

Educating Consumers

Consumers who know what they’re doing are empowered consumers. Regulatory bodies should do more to educate users on stablecoin risks and benefits. We should teach users how to pick reputable platforms, how stablecoins work, and what to watch out for.

Conclusion

It’s important to address stablecoin volatility as the cryptocurrency landscape continues to grow. As you can see from the headline, “Navigating Stablecoin Volatility: Urgent Imperative for Regulatory Safeguards to Protect Consumers.” Stablecoin volatility presents a lot of challenges to regulators, so they need to make sure that guidelines are clear, they’re transparent; they educate the consumers. If we don’t, we might not just ruin individual users’ lives, but also the entire financial system. International regulators should work together to build a cohesive framework for stablecoins that protects consumers and fosters a secure environment for continued growth.

A Beginner’s Guide to Blockchain Technology

A Beginner’s Guide to Blockchain Technology  Cryptocurrencies Uncovered in Cybercrime

Cryptocurrencies Uncovered in Cybercrime  Bitcoin Futures and Cryptocurrency Market Dynamics

Bitcoin Futures and Cryptocurrency Market Dynamics  Cryptocurrency: Digital Currency in Marshall Islands

Cryptocurrency: Digital Currency in Marshall Islands  Bitcoin’s Evolution: Five Investor Demographics

Bitcoin’s Evolution: Five Investor Demographics  Facebook: Cryptocurrency for a Digital Nation

Facebook: Cryptocurrency for a Digital Nation