Recent changes have transformed retail. “Buy Now, Pay Later” (BNPL) programs are now used by buyers. They offer shoppers options to buy and pay at another date. Many are drawn to these delayed payments.

However, unnoticed risks exist. Buyers are cautioned to be wary of these risks. These pitfalls can have an unbelievably big impact. So, it is important that buyers understand them well.

The Allure of BNPL Services

I shop differently now; new ways are here. I can pay later; it’s getting common. People really like it because they can spread the cost without extra charges and it’s easy to sign up; this helps me handle my money better.

Convenience vs. Consequence

You can easily get stuff with BNPL. If you don’t have all the money right now, you can still buy expensive things. Lots of different people like this way of shopping, but it’s really popular with young buyers who enjoy fun moments and getting things right away. Yet, if you choose this option, when you use BNPL without thinking ahead, sometimes there could be drawbacks. It’s important for you to know that it might hurt you later.

Hidden Fees and Interest Rates

While the allure of interest-free instalments is a key selling point for BNPL services, consumers must tread carefully. Some services may impose hidden fees or revert to high-interest rates if payments are not made within the specified timeframe. It’s essential to read the fine print and understand the terms and conditions to avoid unexpected financial burdens.

Impact on Budgeting

One of the primary concerns with BNPL services is their impact on personal budgeting. The ease of making purchases without immediate financial consequences can lead to overspending. Consumers may find themselves accumulating multiple instalment plans simultaneously, making it challenging to keep track of their overall financial commitments.

Credit Score Implications

Contrary to popular belief, using BNPL services may have implications for one’s credit score. While some services do not conduct traditional credit checks, missed or late payments can still be reported to credit bureaus, potentially affecting a user’s creditworthiness. It’s imperative for consumers to recognize the link between BNPL usage and credit health.

Regulatory Scrutiny and Consumer Protection

The rapid growth of BNPL services has attracted regulatory attention, prompting discussions about the need for increased consumer protection measures. As governments and financial authorities evaluate the potential risks associated with these services, users should stay informed about any regulatory developments that may impact the industry.

Making Informed Choices

Despite the potential drawbacks, BNPL services can be a valuable financial tool when used responsibly. To navigate this landscape successfully, consumers must priorities informed decision-making. Researching different providers, Post-Twitter Landscape: Life Beyond the Tweets understanding their terms, and assessing personal financial capabilities are crucial steps in ensuring a positive BNPL experience.

Educational Initiatives

As the popularity of BNPL services continues to rise, there is a growing need for educational initiatives to empower consumers with the knowledge to make responsible financial choices. Financial literacy programs and resources can play a pivotal role in helping individuals understand the implications of BNPL usage and develop sound financial habits.

Conclusion

The rise of BNPL services signifies a shift in consumer behavior and the way people approach retail transactions. While the convenience offered by these services is undeniable, users must proceed with caution and a thorough understanding of the potential risks involved. Hidden fees, impact on budgeting, credit score implications, and regulatory scrutiny all underscore the importance of informed decision-making.

You’re stepping into “Buy Now, Pay Later”? Go carefully. It’s more than a snappy saying. Remember, stay smart, learn about money carefully, and understand how to use “Buy Now, Pay Later” smartly so you don’t trip up on the hidden troubles. As new gadgets and apps change how we handle our money, move with care—you don’t want the easy shortcuts to mess up your money over time.

Robotics Efficiency: Optimal Object Packing

Robotics Efficiency: Optimal Object Packing  Daron Acemoglu Wins A.SK Social Science Award

Daron Acemoglu Wins A.SK Social Science Award  AI Learning: The Power of Synthetic Imagery

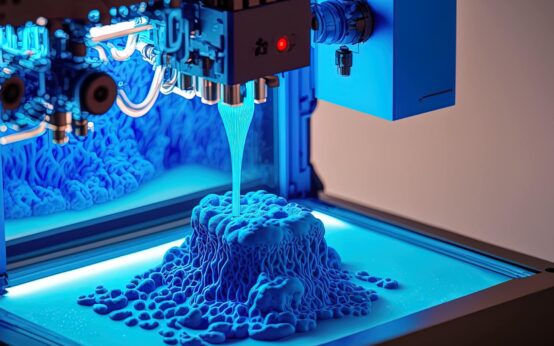

AI Learning: The Power of Synthetic Imagery  Machine Learning’s Role in Perfecting 3D Printing

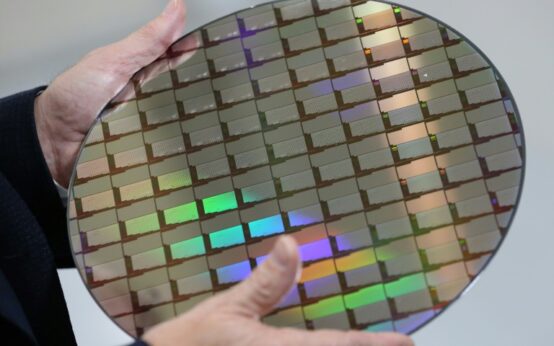

Machine Learning’s Role in Perfecting 3D Printing  Expert Insights on 2047’s Semiconductor Horizon

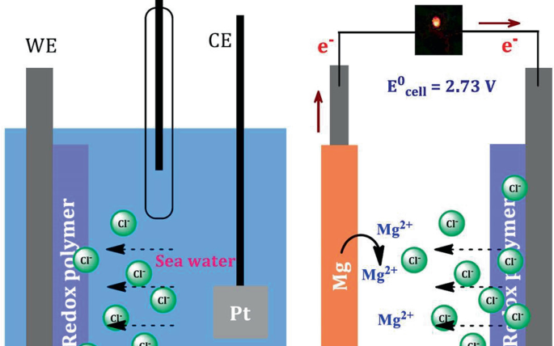

Expert Insights on 2047’s Semiconductor Horizon  Desalination’s Triumph Over Batteries

Desalination’s Triumph Over Batteries