In the vast and dynamic ocean of online trading, there’s a new species making waves: Artificial Intelligence (AI). The phrase “Digital traders want to go fish” aptly captures the essence of how traders, both amateur and professional, are deploying AI to navigate the unpredictable waters of financial markets. Let’s dive deeper into how AI is revolutionizing online trading, turning it into a strategic game of digital angling.

Trading and Technology

The historical context of trading is crucial to understanding its significance. Trading, as an ancient profession, has always revolved around gaining an edge. Traders sought to outperform their competitors from the early days of barter to the bustling floors of stock exchanges.

During the 20th century, computers and the internet made a significant impact on the trading landscape. Digital trading platforms made markets more accessible and transactions faster. Getting everyone access to the same technology, however, levelled the playing field. How could you gain a competitive edge again with such technology?

Enter AI.

Understanding the AI Advantage

Data Crunching at Lightning Speed: Human traders are unable to analyze the vast amount of data generated by financial markets in a timely manner. Through machine learning algorithms, AI can identify patterns and trends in terabytes of data that would otherwise go undetected by humans.

Predictive Analysis: AI doesn’t just process data, it predicts too. By training on historical data, AI models are able to predict market movements, providing traders with insights into possible future scenarios. AI-backed strategies often outperform purely human ones, even though no prediction is foolproof.

Human emotion is one of the greatest pitfalls in trading. Fear and greed are often responsible for impulsive decisions made by traders. AI, since it is devoid of emotion, is focused exclusively on the strategy it has been programmed with, ensuring consistent results.

High-frequency Trading: With the ability to execute thousands of trades in seconds, AI enables high-frequency trading strategies that can capitalize on minuscule price differences that exist for just fractions of a second.

Fishing in Digital Waters

Is there a reason why fishing is used as a metaphor? Just as with fishing, where you want to predict where fish will be and to use the right bait, in online trading you want to predict market movements and position yourself advantageously. AI provides the ‘sonar’ to locate the fish and the ‘perfect bait’ to catch them.

Exploring the Abyss in Tears of the Kingdom: AI allows digital traders to fish sustainably and maintain the health of their portfolios. Just as overfishing can cause a pond to deplete, uninformed or impulsive trading can lead to significant losses.

The Ethical Dimension

A wide range of critics claim that AI-driven high-frequency trading can lead to market manipulation. They argue that these super-fast algorithms cause flash crashes or increase prices artificially.

There’s also the concern of job displacement. As AI takes on more of the trading workload, the need for human traders might diminish. The industry will have to grapple with these issues and possibly introduce regulations to ensure fair play.

Future Prospects

With artificial intelligence advancements, online trading will become more sophisticated, better predictive models will become available, and AI tools will be able to adapt and learn in real-time.

Furthermore, the integration of AI with other emerging technologies, such as quantum computing, might lead to breakthroughs that we can’t even fathom today. Imagine AI systems that can factor in global news, social media sentiment, political developments, and even meteorological data to predict market movements.

Conclusion

In the near future, the online trading ecosystem will undergo a transformation as digital traders increasingly “go fishing” with artificial intelligence. Even though this technological marvel promises higher profits and smarter trading strategies, it posed ethical and economic challenges to the industry as well.

Traders need to adapt and adopt. AI is not the coolest tool of the future; it’s the rod and reel of today’s digital angling. However, to use it effectively, you need to understand its capabilities. As the waters of the financial market continue to swirl and churn, AI-equipped companies will be undoubtedly the winners.

Takeda Fellows at the Forefront of AI in Healthcare

Takeda Fellows at the Forefront of AI in Healthcare  Strategic Design of Neural Network Architectures

Strategic Design of Neural Network Architectures

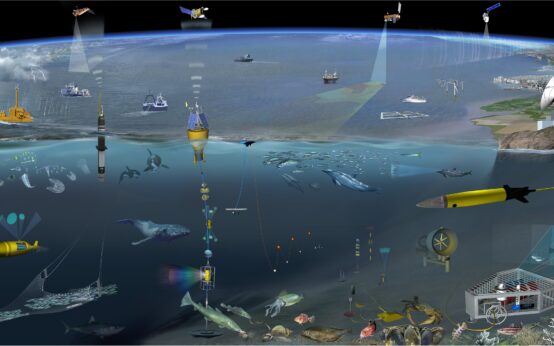

The Future of Ocean Current Exploration

The Future of Ocean Current Exploration  Medical Minds and Machines in Healthcare

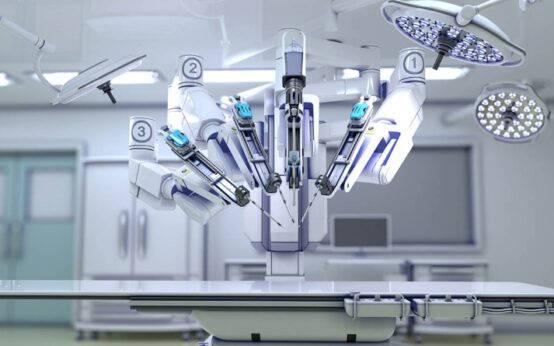

Medical Minds and Machines in Healthcare